Welcome to the Rural Rich Blog!

Learn about Investing

in Rural Real Estate!

How High Interest Rates Can Be Your Friend

Imagine you can transport yourself 25 years into the future. Can you envision how America’s economy, landscape, and socio-economic trends have evolved? Let’s try. Simply answer the following “yes” or “no” questions regarding what you think the future looks like.

Over the Next 25 years…

Population will grow in the United States? Y/N

Urban sprawl will push cities/suburbs further into rural areas? Y/N

Food and agricultural products are in more demand? Y/N

Technology will continue to enable remote work? Y/N

Inflation will still be a challenge? Y/N

The stock market continues to be volatile? Y/N

If you answered “Yes” to these questions, I agree with your assessment. In fact, you don’t need a crystal ball to predict what the future looks like. The same trends hold true if you look at these questions from 25 years ago – population grew, cities expanded into rural areas, more people work remotely, our dollar doesn’t go as far (especially with food prices), and the stock market experienced huge swings.

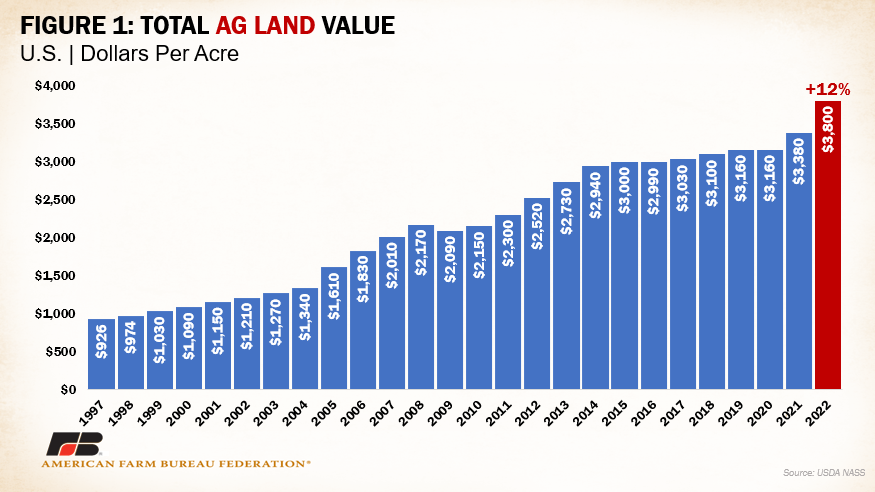

Farmland is an outstanding hedge against inflation with price/acre projected to increase.

Now the million-dollar question…

Based on all you know, do you wish you purchased land 25 years ago? Y/N

For me, the answer is 100% “YES”! In fact, I believe now is one of the greatest opportunities to buy land because of higher interest rates. The current rate environment means sellers are more willing to negotiate – both on the sale price and other factors that create value. For example, in the current rate environment of 2023, I bought rural land for 30% under market rate. Additionally, I negotiated water rights and redrew the boundaries of the tract to fit exactly the shape I desired. Moreover, because buyer demand has slowed, tradesmen are more accessible to complete the work I need to increase the value of the property even further (i.e., fence construction, land clearing, well construction, etc.). If given the choice, I’d rather have interest rates higher than lower because it provides more opportunities for me to find amazing deals all around.

You may ask yourself, “What happens if rates are high when I want to sell my land?” If you were smart about acquiring an exceptional property at an exceptional price, you won't be challenged to sell it for top dollar. As an example, despite interest rates being at an all-time high, I was able to sell a property for the highest price per acre in the entire county. The property was a complete gem when I bought it (incredible views, within a two-hour radius of a major city, surface water, septic system, no tax agricultural exemption, just to name a few). There will always be demand for incredible properties, so take advantage now when the demand to buy is low.

If you bought a farm or ranch in 1997 you would have quadrupled your return on investment by 2022.

In closing, recognize the current juncture of today’s economic environment as an opportune moment to invest in rural real estate. By strategically navigating the challenges posed by higher interest rates, there is the potential not only to secure a property at an advantageous price but also to leverage the prevailing market conditions for future gains. As the demand to buy remains low, the call to action is clear: seize the opportunity now and position yourself for the promising future of rural real estate investment.